FBAPS Leave:

SHO, SL and BR Basis

Written by Hannah Raza, Finance Manager

This is the basis in which the following is calculated:

- Family violence leave

- Bereavement leave

- Alternative holidays

- Public holidays

- Sick leave

The above payments are calculated using relevant daily pay (RDP) or average daily pay (ADP).

What is RDP?

RDP is the value of an employee’s normal working day.

For example, if an employee is employed to work 8 hours a day @ $25, their RDP would be $200.00.

If an employee is on a $60,000.00 salary per annum and they are contracted to work 8 hours a day, 5 days a week, their RDP would also be $200.00 ($52,000.00 / 52 weeks = $1,000.00 / 5 days = $200.00)

What is ADP?

ADP is a daily average of the employee’s gross earnings over the past 52 weeks.

For example, if an employee earnt $55,000.00 over the past 52 weeks and they were paid for 270 days, their ADP would be $203.70 ($55,000.00 / 270 days).

When can ADP be used?

ADP can only be used in place of RDP if it’s not possible to work out the employee’s RDP (e.g. casual holiday pay as you go). However, you can pay any employee the higher of the two (RDP & ADP). Using the above examples, you may choose to pay the employee $203.70 for a public holiday since it’s higher than their RDP of $200.00. However, if their ADP worked out to be less than their RDP e.g. $195.00, you would be required to pay them their RDP of $200.00 for the public holiday.

More can be found here.

AgriSmart’s Additional Option

In AgriSmart, we also offer the option to pay an employee their ADP over the past 4 weeks. This works the same as ADP past 52 weeks except for calculating the earnings history and days paid over a 4 week period instead of a 52 week period.

Therefore, AgriSmart provides the following calculation bases:

- RDP

- ADP past 52 weeks

- Maximum of RDP & 52 week ADP

- Maximum of 4 week ADP & 52 week ADP

- Maximum of RDP, 4 week ADP & 52 week ADP

Table comparing legal requirements & AgriSmart’s recommendation:

Below is table outlining what you are legally required to pay for FBAPS versus what we recommend:

| Employment type | Legal requirement | Our recommendation |

|---|---|---|

| Full-time | RDP | Maximum of RDP, 4 week ADP & 52 week ADP |

| Part-time | RDP | Maximum of RDP, 4 week ADP & 52 week ADP |

| Casual (holiday pay as you go) | ADP past 52 weeks | Maximum of 4 week ADP & 52 week ADP |

| Casual (AL accrues) | RDP | Maximum of RDP, 4 week ADP & 52 week ADP |

| Fixed-term (holiday pay as you go) | RDP | Maximum of RDP, 4 week ADP & 52 week ADP |

| Fixed-term (AL accrues) | RDP | Maximum of RDP, 4 week ADP & 52 week ADP |

We recommend including multiple bases to ensure full compliance, especially when an employee has variable work patterns. For example, if they are employed to work 8 hours a day but end up working close to 11 hours every day in peak season, their ADP would be higher than their RDP and getting paid their RDP over their ADP could be contested.

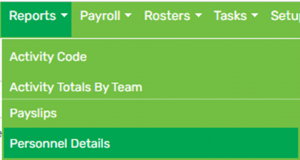

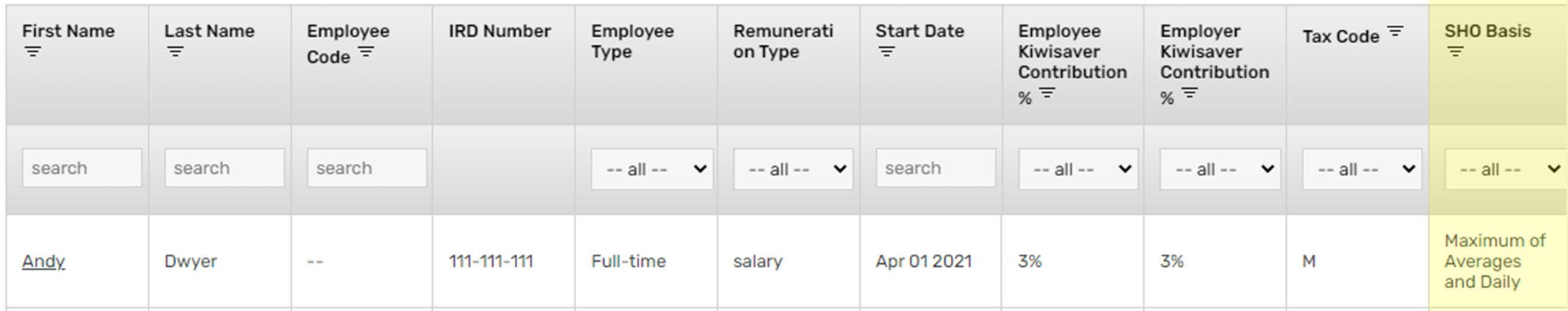

How can I see what my current settings are?

To learn more on what your current settings are, head to the Personnel Details report (found under your Reports header) and locate the SHO basis column (near the far right of the table):

Contact us if you have any queries or would like to change your current settings